How the Affordable Care Act Affects your Business

The Affordable Care Act has affected many of Nevada’s businesses in a number of ways. The Division recommends that each business’ management should consult their own legal and professional advisors as the Division of Insurance can only provide a general overview of the requirements. It is our goal to provide a framework to allow a business to develop a basic understanding of these changes and therefore be able to ask the right questions of their various advisors.

The US Department of Labor and the Internal Revenue Service provide detailed and updated resources that should be utilized in your health insurance decision as a small or large employer. The Department of Labor has a thorough list of helpful links and the IRS provides a Question and Answer for employers under the Affordable Care Act. The below links should be bookmarked or return here as you consider implications for your organization.

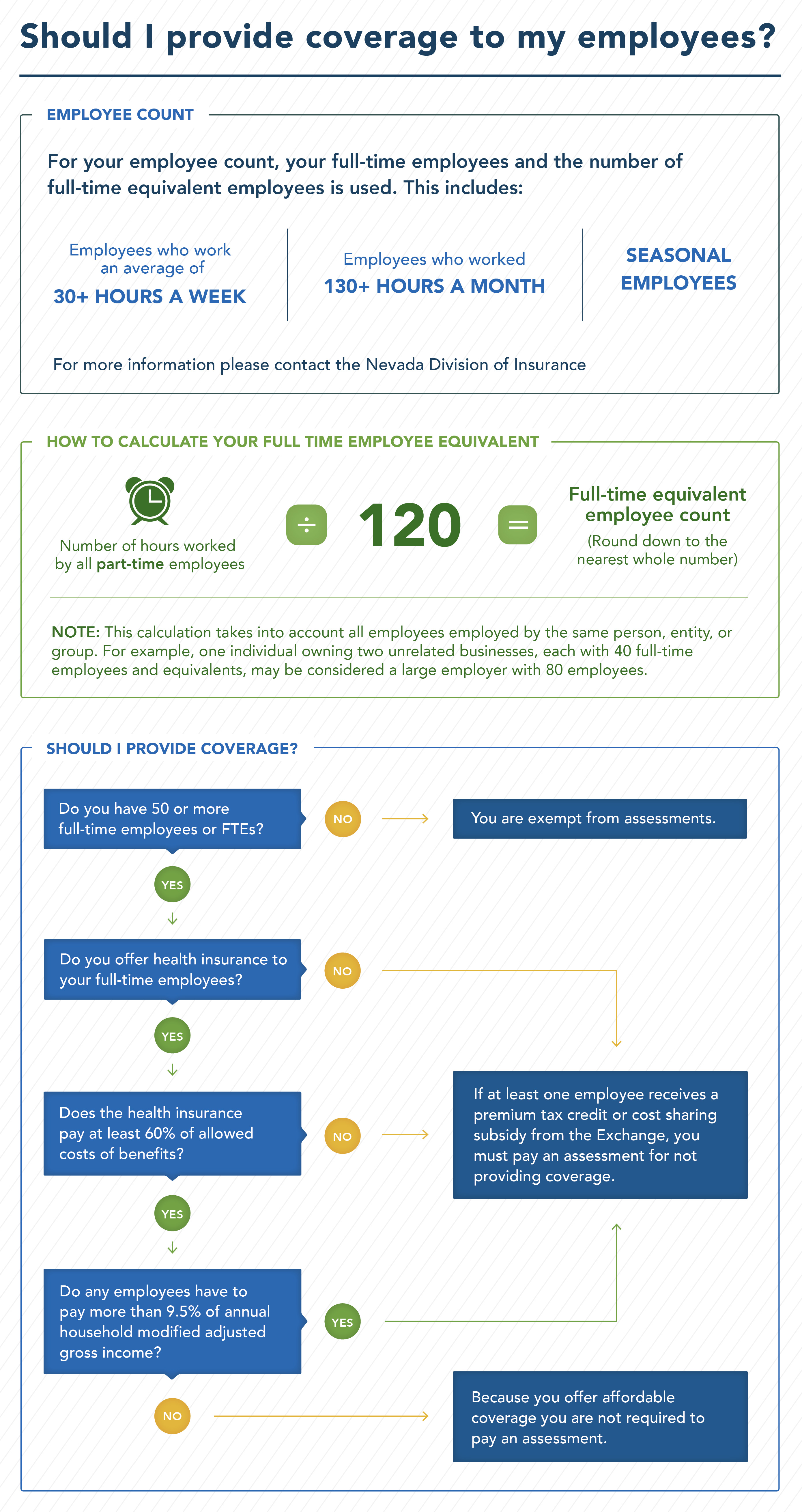

Will I have to provide coverage to my employees?

If you employ 50 or more full-time employees or full-time equivalent employees,and you do not provide affordable minimum essential coverage for your full-time employees (and their dependents), you will be required to pay an assessment to the Internal Revenue Service (IRS).

The law specifically exempts all businesses that have fewer than 50 full-time employees or full-time equivalent employees from this assessment.

For employers who have 50 or more full-time or full-time equivalent employees and who do not offer affordable minimum essential coverage, the assessment will be calculated in one of three ways:

- If you do not provide insurance at all, and if at least one full-time employee receives advance premium tax credits to purchase coverage through the Silver State Health Insurance Exchange, also known as Nevada Health Link, the assessment will be $2,000 for each full-time employee you employ after the first 30 employees.

- If you provide insurance but it does not qualify as “minimum essential coverage,” the assessment will be $3,000 for each full-time employee you employ that is not offered minimal essential coverage.

- If you provide insurance that does qualify as “minimum essential coverage” but that insurance does not meet the “minimum value” or is unaffordable, meaning that an employee’s contribution exceeds 9.5 percent of their modified adjusted gross income, the assessment will be $3,000 for each full-time employee that fails the 9.5 percent affordability test.

What is a full-time employee?

For the sake of your employee count, your full-time employees and the number of full-time equivalent employees is used. This includes:

- Employees who work an average of 30 hours or more a week.

- Employees who worked 130 hours or more per month.

- The number of hours worked by all part-time employees divided by 120 (rounded down to the nearest whole number). This is your full-time equivalent employee count.

- Seasonal employees are included in your count, for more information please see the “Questions for Large Employers” section.

Calculating Your Annual Average Employee Count

To calculate your annual average, add the monthly totals of full-time and full-time equivalent employees from the last calendar year, and divide the total by 12. Round down to the nearest whole number.

It is important to note that this calculation takes into account all employees employed by the same person, entity, or group. For example, one individual owning two unrelated businesses, each with 40 full-time employees and equivalents, may be considered a large employer with 80 employees. If you have questions specific to your situation or use an employee leasing or temp company, please consult an attorney.

For more information about determining whether or not your employees are full-time, visit https://www.irs.gov/affordable-care-act/employers/identifying-full-time-employees.

What is minimum essential coverage?

In order to qualify as minimum essential coverage, a plan must be an employer-sponsored plan defined as, with respect to an employee, a group health plan (including both fully insured and self-insured plans) or group health plan insurance coverage offered by an employer to an employee that is (1) any health benefit plan offered in the small or large group market within Nevada; or (2) a health plan treated as being grandfathered under the Affordable Care Act that is offered in the group market.

What is minimum value?

Minimum value is defined by the U.S. Department of Health and Human Services as coverage of at least 60 percent of the total allowed cost of benefits provided under the plan—it is a measure of benefits, not a measure of premium.

A minimum value calculator will be made available to employers by the IRS and Department of Health and Human Services. Employers can input certain information about the plan, such as deductibles and copay, into the calculator and get a determination as to whether the plan provides minimum value. If the plan covers at least 60 percent of the estimated total allowed cost, the plan will meet the “minimum value” test.

How do I know whether the coverage that I provide is “affordable?”

If an employee’s share of the premium for employer-provided coverage would cost the employee more than 9.5 percent of that employee’s annual household modified adjusted gross income, then the coverage is considered “unaffordable” for that employee. If you offer multiple health care coverage options, the affordability test applies to the lowest-cost option available to the employee that also meets the minimum value requirement.

Because employers generally will not know their employee’s household incomes, employers can take advantage of one of the “affordability safe harbors” set forth in the federal regulations. Under the safe harbors, an employer can avoid a payment if the cost of the coverage to the employee would not exceed 9.5 percent of the wages the employer pays the employee that year, as reported in Box 1 of Form W-2, or if the coverage satisfies either of two other design-based affordability safe harbors.

For more information about safe harbors visit the IRS.gov Question and Answer page and section 54.4980H-5of the ESRP regulations.

Will my part time and seasonal employees be counted for the purpose of the assessment?

To be subject to the assessment, you must employ at least 50 full-time employees or a combination of full-time and part-time employees that equals at least 50.

For example, 40 full-time employees employed at least 30 hours per week on average plus 20 half-time employees working 15 hours per week on average would be the equivalent of 50 full-time employees. As an employer, you must determine each year, based on your current number of employees, whether or not you will be required to pay an assessment.

For example, if you have at least 50 full-time employees (including full-time equivalents) in the prior calendar year, then you will be required to pay an assessment.

If you have seasonal employees, then you must average the number of employees across the months in the year to see whether you have 50 or more employees. The averaging can take into account fluctuations throughout the year. If you are close to the 50 full-time employees (including equivalents) and want to know what to do for 2015, a special transition relief program has been proposed. The regulations issued by the IRS provide additional information about determining the average number of employees for a year and information about how to take account of salaried employees who may not clock their hours and additional information on seasonal workers. Additional information is available at: http://www.healthcare.gov or https://www.dol.gov/agencies/ebsa/laws-and-regulations/laws/affordable-care-act/for-employers-and-advisers.

Employers will not have to pay an assessment if two conditions are met: The employer averages 50 or more full-time employees (including equivalents) for 120 days or less, and the employees who bring the employer over the 50-employee threshold are seasonal workers. If these two conditions are met, the employer is not subject to the assessments that would apply for failing to provide coverage to full-time employees.

I have 50 or more employees; can I supplement my employees’ income instead of offering insurance?

There is no provision for a monetary payment to the employee to avoid the assessment. According to Section 4980H of the Internal Revenue Code, an employer with 50 or more employees could be subject to assessment if any full-time employee is certified to receive an advance premium tax credit or cost-sharing reduction. Generally, this may occur where either: (1) the employer does not offer to its full-time employees (and their dependents) the opportunity to enroll in minimum essential coverage under an eligible employer-sponsored plan; or (2) the employer offers its full-time employees (and their dependents) the opportunity to enroll in minimum essential coverage under an employer-sponsored plan that is either unaffordable relative to the employee’s household income or does not provide minimum value.

Other changes that affect Employers

Health Care Reform affects Small Employers and Large Employers differently. Therefore, it is important to know how your business will be classified when considering how you will be impacted.

An employer with anywhere from one to 50 full-time or full-time equivalent employees is considered a Small Employer.

An employer with 51 or more full-time or full-time equivalent employees is defined as a Large Employer.

A sole proprietor with no employees, other than family members, must purchase insurance as an individual.

Health Insurance Rates

Since 2014, how health insurers rate individuals and small businesses has changed. They can only use age, composition of family, geographic area and tobacco as rating factors. Nevada has also expanded its review of health insurance rates. Nevada now reviews all health insurance rate changes in the individual and small group insurance markets.

The law also requires insurance companies to spend the majority of your premium dollars on health care. This means that insurers selling policies to individuals or small groups must spend at least 80 percent of premiums on direct medical care and efforts to improve the quality of care or provide a premium rebate to their customers.

The Nevada Division of Insurance is committed to consumer protection and transparency in regard to the cost of your health insurance, read more about health insurance rates in Nevada here.

Guidance when you need it most

Purchasing insurance for your business can be confusing. As you navigate the Affordable Care Act and the challenges and opportunities it has created in the health insurance marketplace, remember that the Nevada Division of Insurance is here to help you.

If you still have questions after reading this guide and talking to your agent, broker or insurance company, please contact the Nevada Division of Insurance in Northern Nevada at (775) 687-0700 or from Southern Nevada call (702) 486-4009. The Division may also be contacted from rural areas in Nevada by calling (888) 872-3234.

Remember to always verify with the Nevada Division of Insurance that the person or company you are working with is licensed, certified or authorized to conduct business in this state.